The S&P 500 is approaching an important level to watch beyond its 2022 low, as investors anticipate a spike in jobless claims amid recession fears and soured sentiment in the U.S. stock market, according to an RBC Capital Markets note.

“We think stocks are on the cusp of an important test,” said Lori Calvasina, head of U.S. equity strategy at RBC, in a research note Sunday. “While the June lows now seem unlikely to hold, if the S&P 500 SPX, -1.03% experiences its typical recession drawdown of 27%, the index will fall to 3,501.”

In Calvasina’s view, the 3,500 level is important as it’s “the point at which a median recession would be priced in,” perhaps drawing in some investors to buy the dip. That’s because at that level, based on RBC’s “below-consensus” earnings-per-share forecast of $212 for 2023, the index’s forward price-to-earnings ratio would fall below average if it hits 3,561, according to Calvasina.

“That may open the door for bargain hunters, though fundamental catalysts for a move higher – other than the midterms – admittedly are hard to identify,” she said.

With the Federal Reserve aggressively raising interest rates in an effort to tame stubbornly high inflation, investors have been focused on what “higher-for-longer rates” might mean for stock-market valuations, according to RBC.

RBC expects the S&P 500 may end the year with a price-to-earnings multiple of 16.35x, based on 2022 expectations for inflation and the federal-funds rate from the Fed’s summary of economic projections released after its policy meeting last week. That calculation also factors in a 3.4% yield on the 10-year Treasury note, which assumes the current rate will come down a bit due to recession concerns, according to the note.

Read: Fed will try to avoid ‘deep, deep pain’ for U.S. economy, Bostic says

“The model anticipates a P/E of 16.35x for a 57% contraction from the pandemic high of 37.8x – close to the contraction that was seen in the 1970s and after the Tech bubble,” Calvasina wrote. “If the S&P 500 were to trade at 16.35x on our 2022 EPS forecast of $218, the index would fall to 3,564.”

And S&P 500 price-to-earnings ratio of around 16 is “reasonable,” based on an analysis of multiples versus rates and inflation going back to the 1970s and current views on those areas, according to RBC.

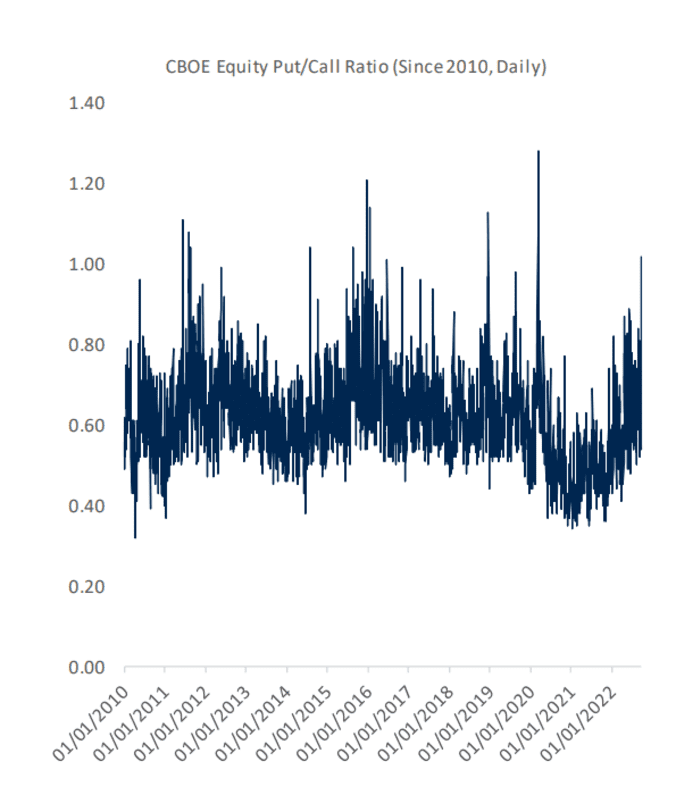

Meanwhile, investor sentiment is “at the low end of its historical range,” said Calvasina. She pointed to the equity put–to-call ratio ending last week at its highest level since the pandemic while approaching December 2018’s high.

Put option contracts give investors the right, but not the obligation, to sell shares at an agreed up price within a specified period. For that reason, they also reflect bearishness in the stock market. Call options, which give investors the right to buy a security at a specified price within a certain time frame, signal a bullish view.

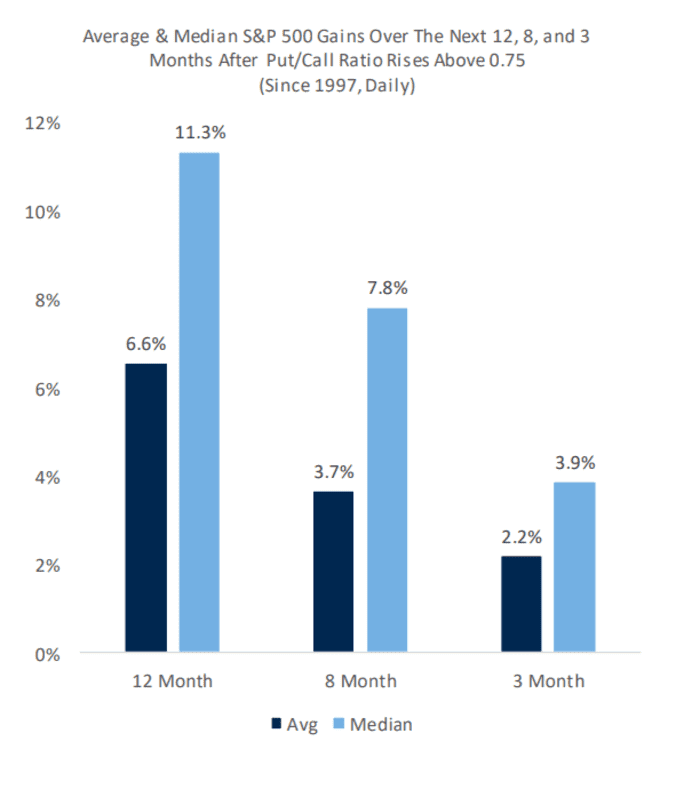

After the put-to-call ratio rises above 0.75, the median gain for the S&P 500 over the next three months is 3.9% based on data since 1997, according to the note. The median gain increases to 7.8% in the eight months following that level, and rises to 11.3% in the next 12 months after climbing above 0.75, the note shows.

The S&P 500, which has tumbled 22.5% this year through Friday, and was trading 1.1% lower Monday afternoon at about 3,654, according to FactSet data, at last check. That’s slightly below the index’s closing low this year of 3666.77 on June 16.

The U.S. stock market was down Monday afternoon, extending last week’s losses as Treasury yields continued to surge after the hawkish outcome of the Fed’s policy meeting last week. The 10-year Treasury yield TMUBMUSD10Y, 3.919% jumped about 20 basis points to around 3.89% in Monday afternoon trading, FactSet data show, at last check.

Read: Morgan Stanley says investors should consider this port in the market storm right now

Techyrack Website stock market day trading and youtube monetization and adsense Approval

Adsense Arbitrage website traffic Get Adsense Approval Google Adsense Earnings Traffic Arbitrage YouTube Monetization YouTube Monetization, Watchtime and Subscribers Ready Monetized Autoblog

from Stock Market News – My Blog https://ift.tt/lPYd3Eo

via IFTTT

No comments:

Post a Comment